We know what you're thinking. I can't afford to buy tenant insurance. I'm already paying rent and have enough expenses to cover each month. But how much do you think it would cost to replace all the items in your apartment in the event of a fire or water damage? Let's do a little math…

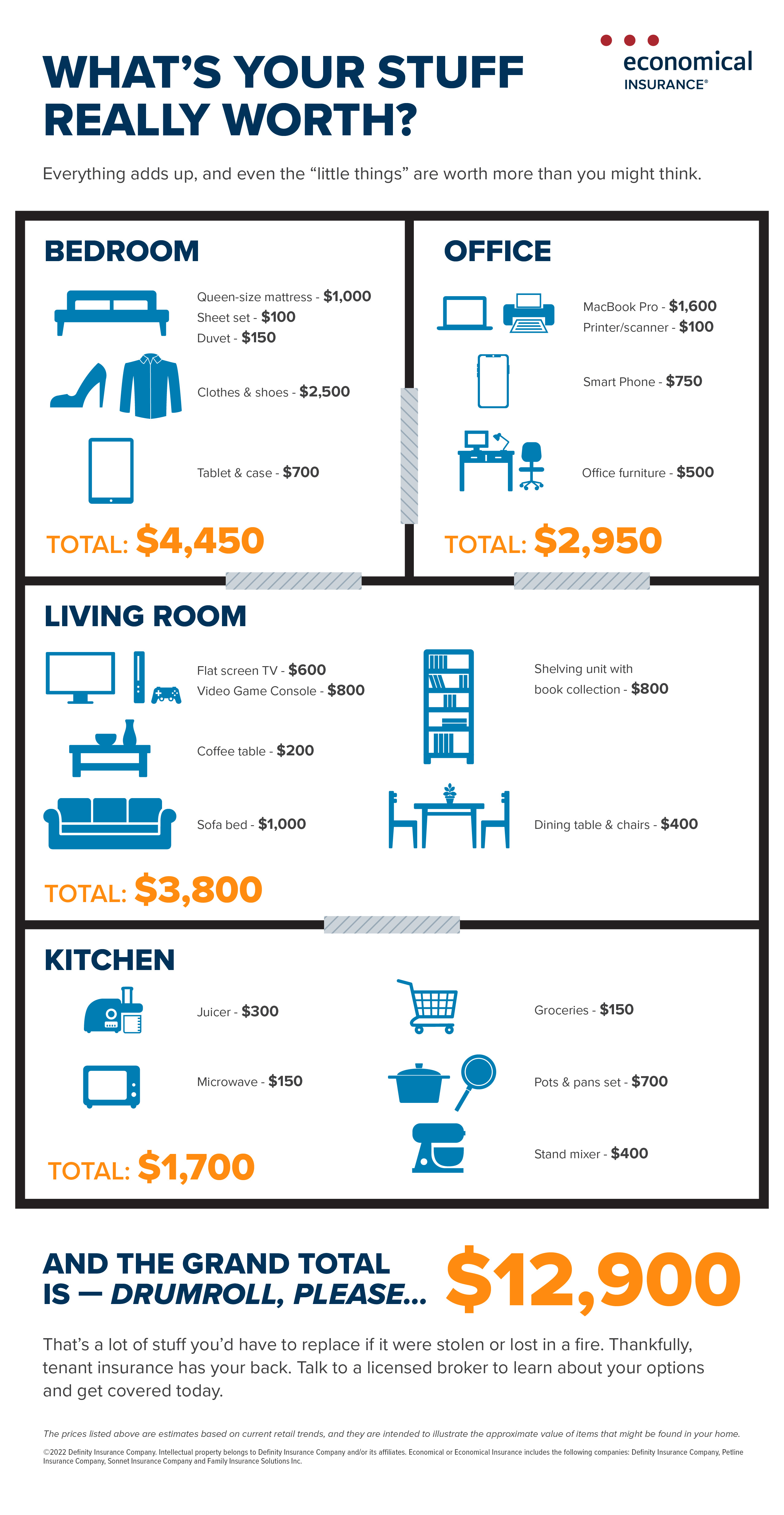

What’s your stuff really worth?

Everything adds up, and even the “little things” are worth more than you might think.

Bedroom

- Queen-size mattress, $1,000

- Sheet set, $100

- Duvet, $150

- Clothes & shoes, $2,500

- Tablet and case, $700

Total: $4,450

Office

- MacBook Pro, $1,600

- Printer/scanner, $100

- Smart Phone, $750

- Office furniture, $500

Total: $2,950

Living room

- Flat screen TV, $600

- Video Game Console, $800

- Coffee table, $200

- Sofa bed, $1,000

- Shelving unit with book collection, $800

- Dining table & chairs, $400

Total: $3,800

Kitchen

- Juicer, $300

- Microwave, $150

- Groceries, $150

- Pots and pans set, $700

- Stand mixer, $400

Total: $1,700

And the grand total is — drumroll, please... $12,900

That’s a lot of stuff you’d have to replace if it were stolen or lost in a fire. Thankfully, tenant insurance has your back. Talk to a licensed broker to learn about your options and get covered today.

The prices listed above are estimates based on current retail trends, and they are intended to illustrate the approximate value of items that might be found in your home.

©2022 Definity Insurance Company. Intellectual property belongs to Definity Insurance Company and/or its affliates. Economical or Economical Insurance includes the following companies: Definity Insurance Company, Petline Insurance Company, Sonnet Insurance Company and Family Insurance Solutions Inc.

All in all, you likely have at least $13,000 worth of stuff that you'll have to replace if it's destroyed in a fire or flood. Without tenant insurance, not only will you need to find a new apartment and pay for a place to stay in the meantime, but you'll likely need to replace that $1,600 laptop and $1,000 mattress yourself, too.

Paying a small monthly premiumopens a pop-up with definition of premium to protect your belongings could potentially save you thousands in the future. Most renters pay between $250 to $350 each year for tenant insurance — which breaks down to $20 to $30 a month. Compared to $13,000 to replace all your belongings, tenant insurance really is worth the price tag.

Tenant insurance has you covered when it matters most — and it protects a lot more than your stuff. Learn about some of the other ways tenant insurance can protect you or talk to your broker to find out more.

Share this article on Facebook or Twitter to help other renters get protected, too.